The ongoing paradigm shift in the mobility segment toward electric vehicles (EVs) created a need to build out the entire value chain. Consequently, demand for materials like lithium and lithium-ion batteries has increased meaningfully in recent years. Compared to consumer electronics, EV batteries can contain thousands of times more lithium by weight and anywhere from tens to thousands of times more lithium-ion cells. While many investors are familiar with dedicated electric automakers such as Tesla and Rivian, there’s an entire ecosystem of companies further up the value chain making the EV revolution possible.

In this piece, we highlight four key players in the lithium and battery space. It serves as a follow-up to our 2020 piece by the same name.

- BYD: Vertically integrated battery and EV manufacturer with top market share in both segments

- Arcadium Lithium: New lithium major following the merger between Allkem and Livent

- Albemarle: Global lithium producer with ambitious expansion plans

- LG Energy Solutions: Critical battery supplier for ex-China automakers

BYD: The Integrated Battery Maker

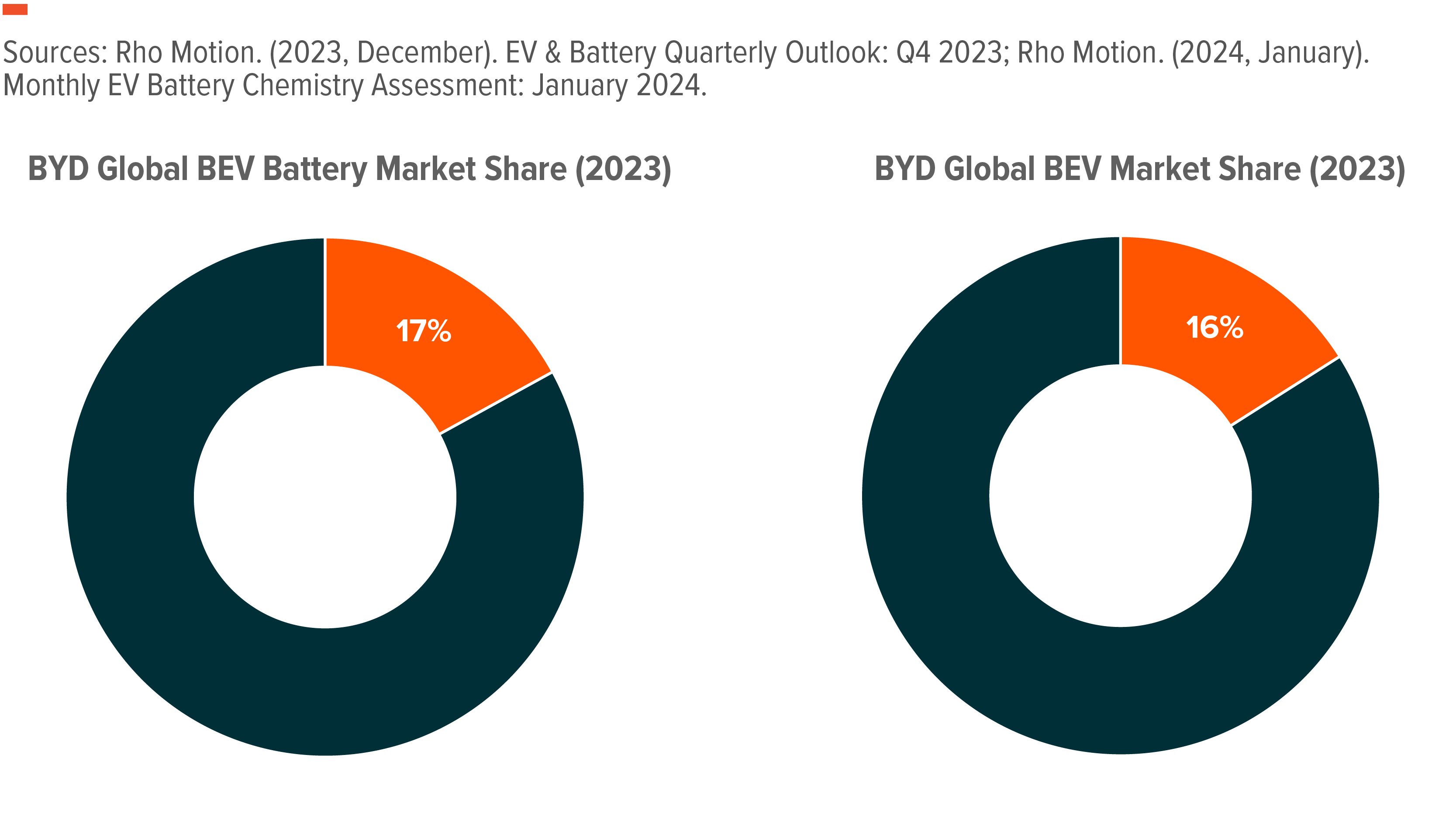

BYD is a Chinese battery maker turned automaker that sold more battery electric vehicles (BEVs) than any other company in Q4 2023.1 BYD is unique for its dominance as a manufacturer of EVs and batteries, and for a virtually unmatched level of vertical integration. In 2023, BYD was the second largest battery maker and the second largest BEV producer by market share.2,3 If plug-in hybrid sales are included, BYD was the largest seller of EVs by a wide margin. No other automaker possesses meaningful market share in the global EV battery industry.

BYD has been able to keep costs down and sell increasingly inexpensive models thanks to its in-house capabilities in batteries and even semiconductors. The BYD Seagull at USD 11,400 and Dolphin at USD 31,000 are some of the least expensive EV models in the world.4,5 Integration has also helped BYD improve margins even with increasing competition in the Chinese automobile market. Between Q3 2022 and Q3 2023, BYD’s net profit margin increased by nearly 70%, compared to net margin across the Nasdaq OMX Global Automobile Index, which declined about 32%.6

Outside of internal usage, BYD also sells its batteries under its Blade series to automakers such as FAW, Toyota, Volvo, and Ford.7 As an iron-based phosphate (LFP) specialist, BYD devotes close to 100% of its capacity toward this chemistry.8 LFP batteries have become an important portion of the lithium-ion chemistry mix because of their relatively low cost and long lifespans compared to higher energy density architectures. However, very little LFP expertise exists outside of China, and as automakers look for ways to improve unit economics, they may have to partner with suppliers such as BYD.

BYD is likely to enhance its efforts to expand globally and to continue to build on its already market-leading integration. About 8% of BYD’s unit sales were from exports in 2023, a share that we expect to grow.9 In late 2023, the company confirmed plans to build a factory in Szeged, Hungary in a clear bid to expand into Europe.10 At the time of writing, BYD was also reportedly in talks with lithium miner Sigma Lithium regarding a possible supply agreement, joint venture, or acquisition.11

Arcadium Lithium: A New, Fully Integrated Lithium Major

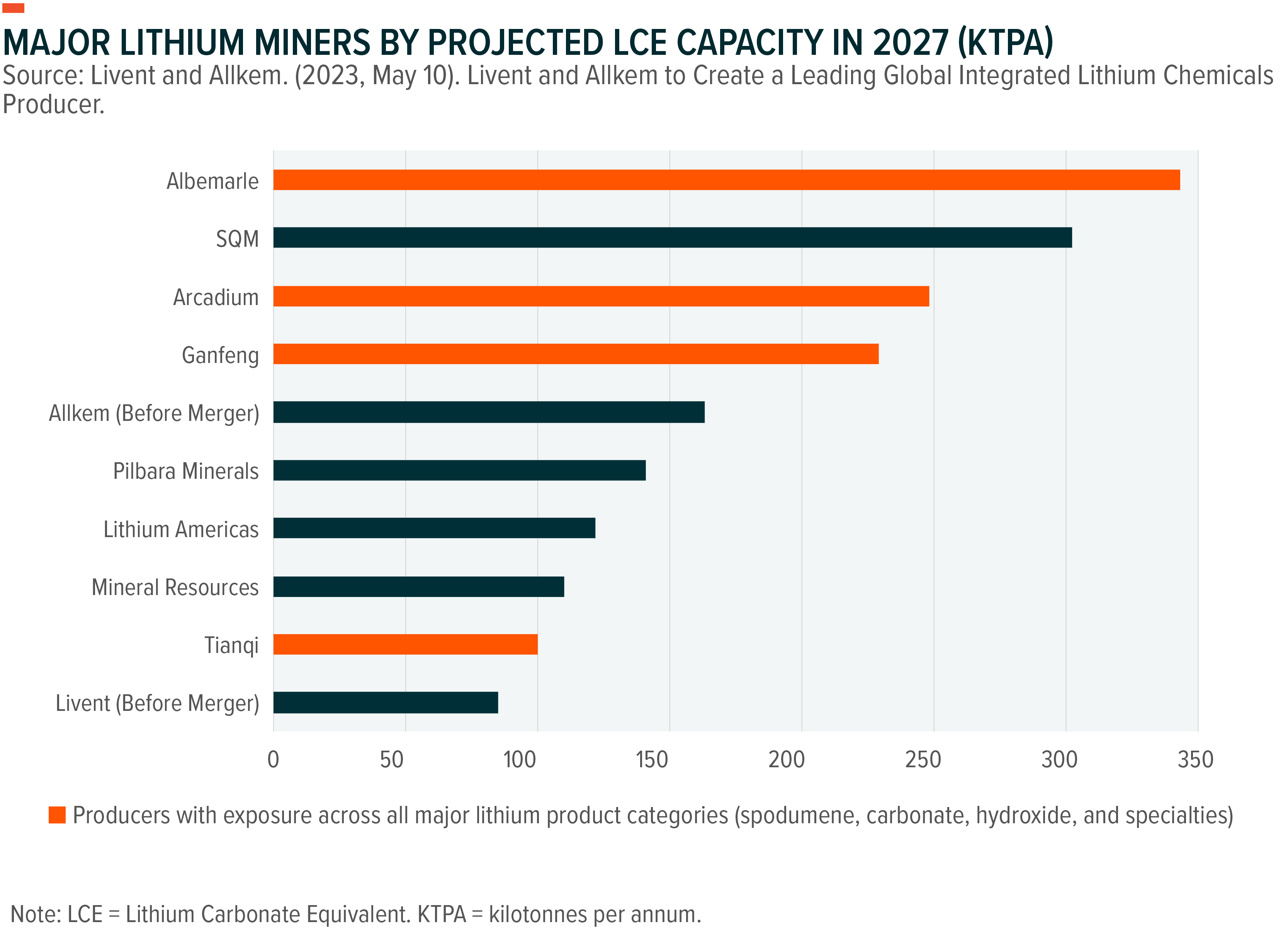

Finalized in early January 2024, the merger of Livent and Allkem is the largest such event in the lithium industry’s history. The combined entity, Arcadium Lithium (“Arcadium”), joins Albemarle, Ganfeng, and Tianqi as lithium producers with offerings across all major lithium product segments, including spodumene, carbonate, and hydroxide.12 By Arcadium’s estimates, the company will be the third largest lithium producer by capacity in 2027.13

Before the merger, Allkem focused on lithium production from conventional brine and hard rock mining, specifically from assets in Argentina, Australia, and Canada. Livent was more of a dedicated lithium refiner and specialty chemical producer with operations in Argentina, Australia, Canada, the United Kingdom, and China. Synergies between these business lines are expected to unlock cost savings while the placement of assets could improve logistics.

The geographic footprint of Arcadium’s supply chain could position the company to benefit from the Inflation Reduction Act (IRA) in the United States. The IRA provides various incentives to boost EV and battery manufacturing, but it requires a minimum threshold of minerals to be produced or processed domestically or in countries that maintain fair trade agreements with the United States. Much of Arcadium’s production capacity is likely to align with IRA sourcing requirements, which could boost the attractiveness of the company’s lithium for customers downstream who are trying to become eligible for the incentives.

Arcadium could also be a name to watch in the emergent direct lithium extraction (DLE) segment. DLE is an umbrella term referring to technologies that produce lithium from brine resources without the need for prolonged evaporation pond usage. The technology remains in its early stages, but pilot programs show promising water and resource savings. Innovations in DLE could drastically improve the economics of existing brine operations and expand the amount of lithium deposits that are viable for development around the world. Livent has operated a DLE-augmented process in Argentina since 1998 and Arcadium is slated to expand its efforts in this field.14 In December 2023, Livent acquired a minority stake in the parent company of DLE technology firm ILiAD Technologies and plans to license the company’s tech in future endeavors.15

Albemarle: A Growing Giant

In any given year, Albemarle competes with SQM and Ganfeng for the crown of largest lithium producer in the world. As of September 2023, Albemarle boasted the world’s largest lithium salt capacity and was the most valuable lithium producer by market capitalization.16 The company operates extraction and conversion facilities around the world and has access to some of the highest-grade lithium resources, including Greenbushes in Australia and the Salar de Atacama in Chile.17,18

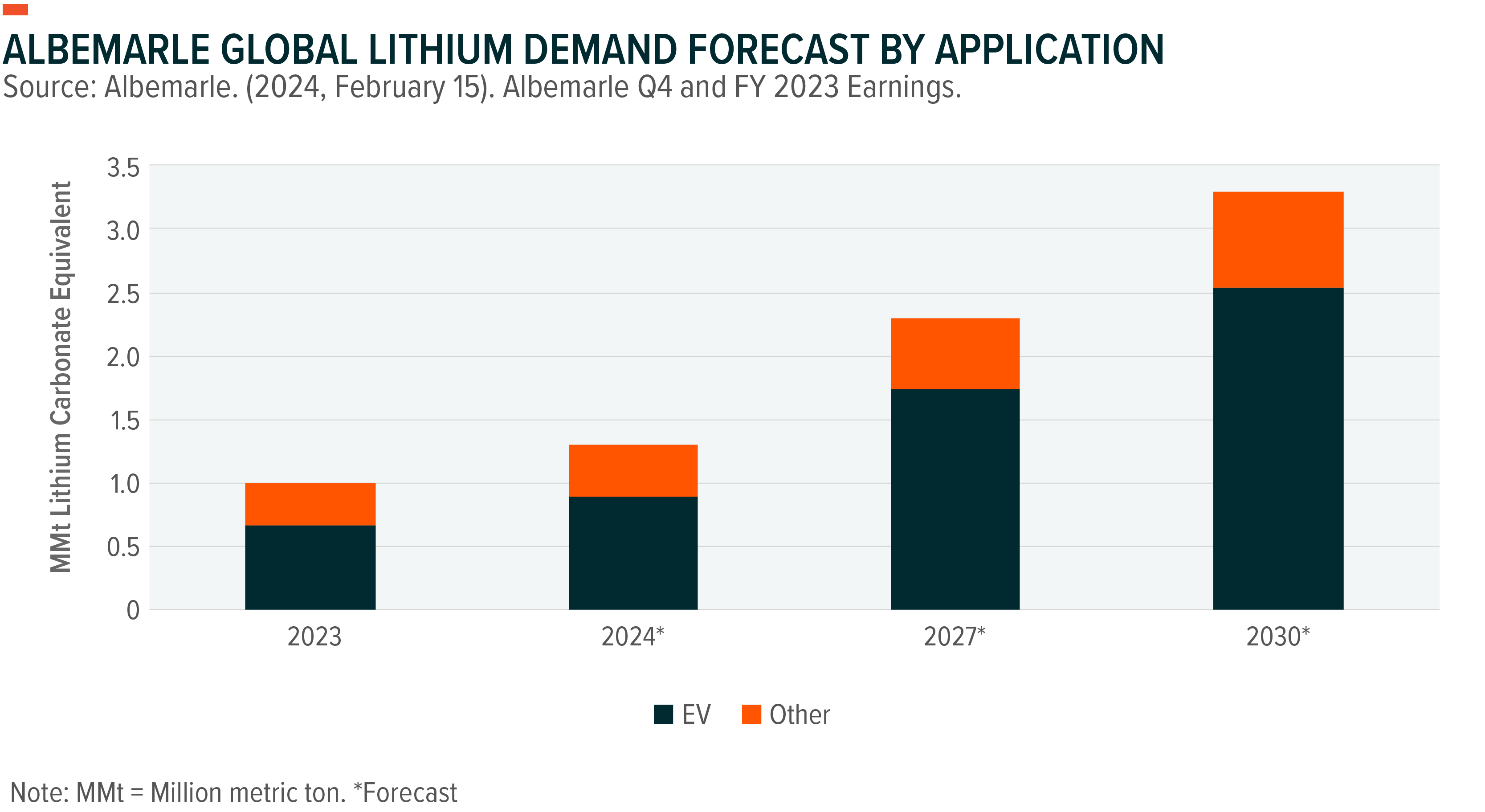

Even as the world’s top lithium producer, Albemarle maintains an aggressive project pipeline. The company plans to boost lithium production and conversion capacity by as much as 3x between 2022 and 2030, which aligns with the company’s long-term expectations for lithium demand.19 Albemarle expects global lithium demand to grow by about 3.1x between 2023 and 2030, with more than 80% of that demand growth likely to come from EV applications.20

Expansions to current lithium projects could be Albemarle’s growth engine in the coming years. In the near term, expansion efforts at Greenbushes and Wodgina in Australia and improved efficiency from various South American projects are expected to boost output. In the second half of the decade, Albemarle expects to recognize more contributions from its American assets, namely King’s Mountain, North Carolina, and Magnolia, Arkansas.

Currently, Albemarle operates the only lithium-producing mine in the United States, the Silver Peak mine in Nevada, and the company will likely be involved in the U.S. government’s efforts to ramp up critical material production.21 Since 2022, Albemarle has received $240 million in government grants and loans to support the development at King’s Mountain.22,23

Additionally, high-profile offtake agreements and partnerships are likely to remain a focus for Albemarle. In May 2023, the company announced a definitive agreement with Ford to supply 100,000 metric tons of battery-grade lithium hydroxide between 2026 and 2030.24 This deal would be enough to supply as many as 3 million EVs.25 In September 2023, Albemarle reached an agreement with Caterpillar to supply the construction and mining equipment manufacturer with lithium for battery-powered machinery.26

LG Energy Solution: A Key Supplier for Growing EV Markets

Today, three-plus years after its September 2020 spin-off from LG Chem to accommodate rising demand for batteries from the auto industry, LG Energy Solution sits just behind BYD as the third largest EV battery maker by market share.27 The company has established a global operational presence with manufacturing capacity in South Korea, China, Poland, and the United States, as well as joint ventures with automakers such as GM, Honda, and Hyundai.28,29

The company’s top clients by battery volume include strategically significant automakers like Volkswagen, Tesla, Stellantis, GM, and Ford.30 Battery and EV research provider Rho Motion expects these automakers to all be top 10 BEV producers in 2030, together comprising 39% of the global market.31 LG Energy Solution also recently signed a long-term agreement to supply Toyota with American-made nickel-based based batteries from 2025.32

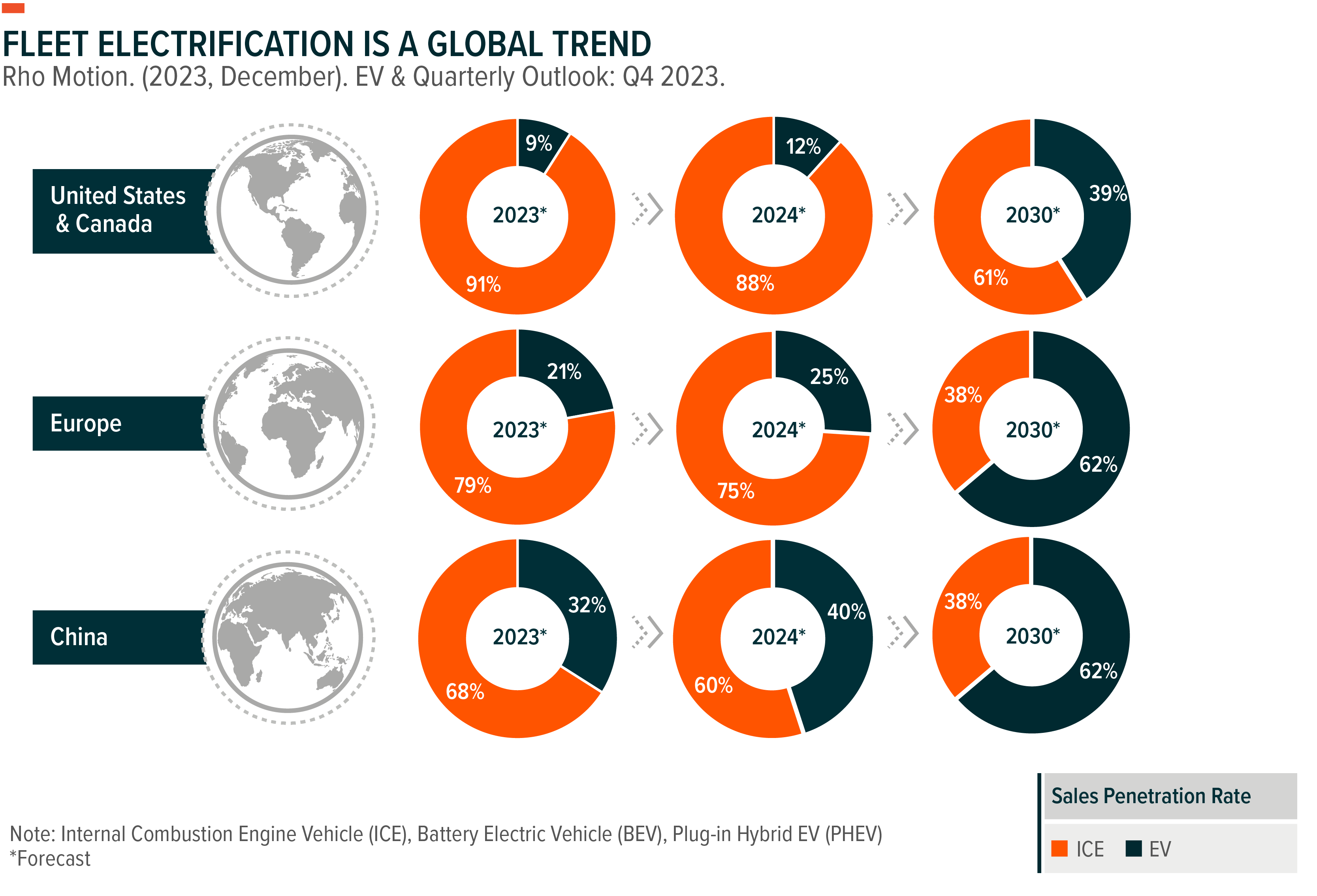

LG Energy Solution’s customer base also positions the company to benefit from further EV penetration in less mature markets. China accounted for nearly 60% of global EV sales in 2023 and is likely to remain the largest market by volume into perpetuity.33 However, because China was an earlier EV adopter, growth rates in other major EV markets could be higher, including North America and Europe, home to most of LG Energy Solution’s customers. Between 2023 and 2030, EV sales in North America and Europe are forecast to grow at compound annual growth rates of 27% and 20%, respectively, compared to 14% in China.34

During its Q4 2023 earnings call, the company reported FY2023 operating profit of KRW 2.2 trillion (USD 1.6 billion), which represented 78% year-over-year growth.35 Notably, about 31% of this operating profit was attributable to IRA incentives.36 Given LG Energy Solution’s manufacturing presence in the United States, management believes IRA incentives may continue to benefit the company.

Conclusion: The Electric Mobility Opportunity Is More Than the EV

The EV value chain is vast, and the four companies highlighted in this piece have been significant players in its growth. Along with these firms, many other lithium miners and battery producers are enabling the transition toward EVs. We believe the lithium and battery industries remain in their early stages, but we expect them to grow significantly as electrified mobility options displace conventional means of transportation. For investors, understanding the full scope of how an EV makes its way to the road can help them capture paradigm-shifting growth in their portfolios.